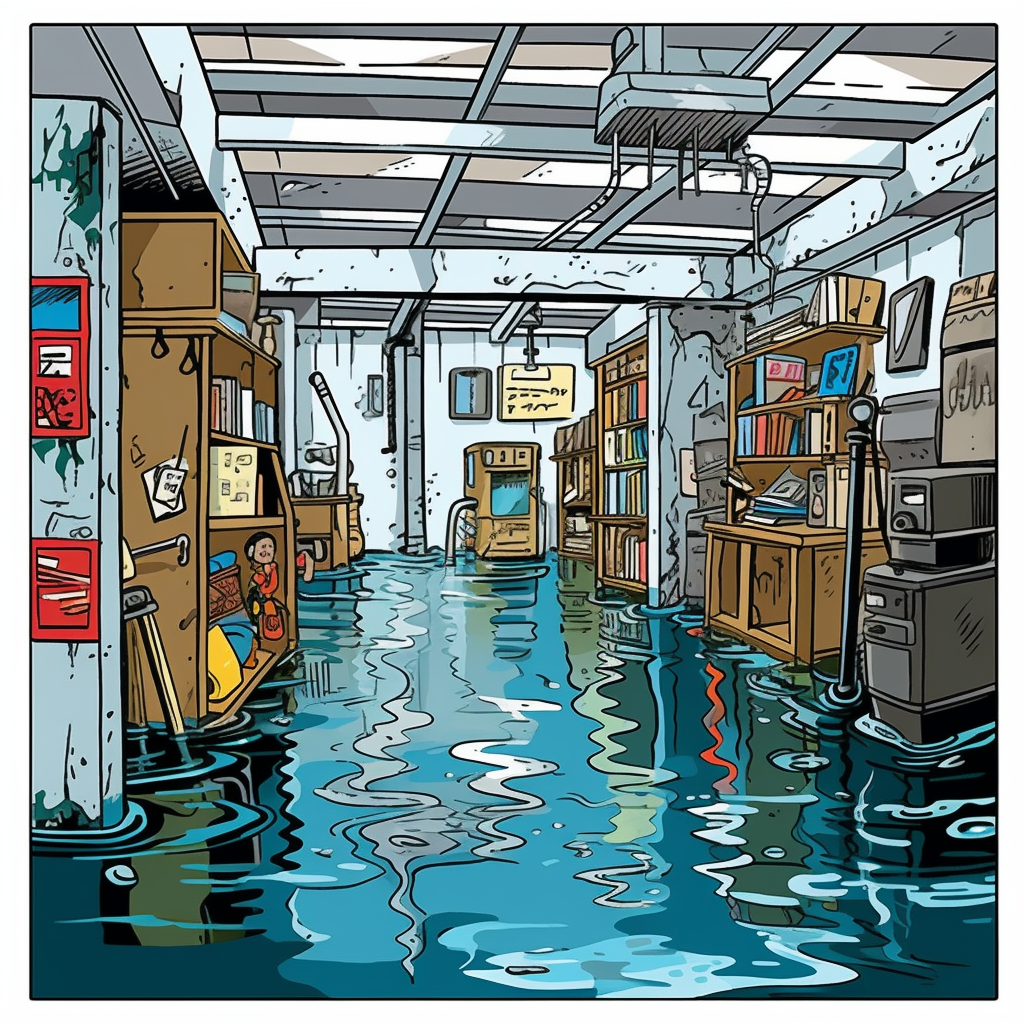

A torrent of rain hit Idaho Falls just yesterday, turning streets into rivers and basements into water reservoirs. Flash floods, unexpected and swift, are a reality across Idaho, Wyoming, and Utah. Many homeowners, however, find themselves unprepared and unprotected. That’s where Inland Flood Coverage comes in.

Bridging the Gap in Flood Coverage

Standard homeowners’ insurance policies typically don’t cover damage caused by flooding. While they protect against issues originating within the home, such as a burst pipe, they often exclude water damage caused by external events like rivers overflowing their banks or flash flooding. This coverage gap can lead to significant out-of-pocket expenses for homeowners.

The Costly Limitations of the National Flood Insurance Program (NFIP)

The National Flood Insurance Program (NFIP), managed by the Federal Emergency Management Administration (FEMA), has been the traditional option for flood coverage. However, NFIP coverage can be expensive and often falls short of meeting the needs of homeowners in low-to-moderate flood-risk zones. High premiums, deductibles, and limitations on what is covered can leave homeowners seeking more comprehensive options.

Introducing Inland Flood Coverage: Tailored and Affordable

Inland Flood Coverage is specifically designed to fill the flood coverage gap in standard homeowners’ insurance. Unlike the NFIP, Inland Flood Coverage provides affordable and comprehensive protection for homeowners in low-to-moderate flood-risk zones.

Inland Flood Coverage includes:

- Buildings: Provides coverage for your main house and other structures on your property.

- Contents: Protects your personal belongings, even those located in the basement, an area often excluded by standard flood insurance.

- Additional Living Expenses: This covers the costs of temporary accommodation if your home becomes uninhabitable due to a flood.

- Property Relocation: Some policies even cover the expenses associated with moving your property to safety in the event of a flood.

- Debris Removal: Helps with the costs of removing flood debris from your property.

Coverage options and premiums may vary among insurance companies. That’s why it’s essential to consult with your Page Insurance agent. We can provide guidance and help you navigate the options to find the best coverage tailored to your specific needs.

Note: Other optional coverages like ‘sewer backup’ and ‘water backup.’ Policies aren’t milk – where they’re basically the same everywhere you go. They need to be personalized to what you want. The Page team can help!

Taking the Next Steps: Protecting Your Home with Inland Flood Coverage

To add Inland Flood Coverage to your homeowners’ insurance policy, follow these steps:

- Consult with your Page Insurance agent: We’re here to discuss your needs and guide you through your options, ensuring you understand the details of Inland Flood Coverage.

- Policy Review and Amendment: If you decide to add this coverage, we will review your current policy and initiate the amendment process to include Inland Flood Coverage.

- Start or Renewal Time: The most straightforward time to add this endorsement is when you’re starting a new policy or during the policy renewal period. However, it can typically be added at any time during the policy period.

- Stay Informed: Thoroughly read your policy and ask questions to ensure you understand the coverage details.

Don’t Wait Until It’s Too Late

Just one inch of water in a home can cause more than $25,000 in damage, according to the National Flood Insurance Program (NFIP). With the intensifying weather patterns due to climate change, the risk of flood events is increasing. It’s crucial not to overlook the importance of protecting your home.

The recent flash floods in Idaho Falls serve as a stark reminder that floods can happen unexpectedly, anywhere, and at any time. Inland Flood Coverage provides the protection you need to weather these storms.

Your Page Insurance agent is ready to assist you in finding the right coverage for your needs. If coverage against flooding is something you’d like to further explore, contact us today!